Bridging Finance – Blog

Funding from £75,000 up to £25 million

Helping you secure a short-term financial solution to your specific bridging finance London requirements

Regulated Bridging Finance / short term funding

Can a non-regulated adviser do a regulated bridging finance case? Answer no although, I will discuss the following how we assisted a customer in obtaining funding in this circumstance. The customer resides in their own home with no mortgage or other debts secured....

Bridging refinance on a HMO

Bridging refinance on a HMO We class a BTL - Buy to Let and a HMO House of Multiple occupancy as both semi commercial assets as the owner receives an income from the tenants. New case just came in as follows – Client has a 950,000.00 asset, no mortgage and requires a...

100% commercial Bridge funding

Can you obtain 100% bridge funding secured upon a commercial asset, yes. An office block that has planning for residential apartments and which can be purchased for 1.5m with an open market value of 2m. Some bridge funders will accept the higher open market value for...

Development exit finance = Development exit bridge finance = Short term development exit funding

Development exit finance = Development exit bridge finance = Short term development exit funding All the above are the same just with alternative names, don’t be confused. Additionally, they all are doing the exact same job of paying off your development funding...

Tips on applying for bridging finance with a funder

Tips on applying for bridging finance with a funder This is for unregulated bridge funding meaning, you are not taking a charge on your current property you reside within nor the next property either using bridging finance that you will live within as both are deemed...

Bridging finance for land purchase and log home development

Bridging finance for land purchase and log home development Bridging finance, Bridging loans, short term funding, Development funding, Development finance, short term finance. All the above are classed aa short term secured funding. Secured as, the loan offered by the...

Why use bridging finance

WHY USE BRIDGING FINANCE? My answer, why not as it has so many benefits when getting you from A to B in the arena of property matters. People in the know call it Bridging Finance and others, a Bridging Loan, both are correct in their terminology of this financial...

Bridging Finance Explained

Bridging Finance Explained Bridging finance is classed as a shorter-term loan utilsed to bridge the gap between say a purchase and a sale, or between a short-term financial need and a long-term funding solution. Typically used for a variety of property requirements...

Bridging Finance Loans In 2025

BRIDGING Finance LOANS IN 2025 Good news now the Bank of England have reduced the rate of interest to 4%, we should see even more borrowing / lending in the bridging loans and property development funding arena. Opportunities Depending on the make-up of the deal...

How big is the bridging loan market financially

How big is the UK bridging loan market financially? The Bridge loan market which would also include development funding / lending, runs into billions of pounds being borrowed by limited companies and individuals for so many reasons ranging from purchasing a property...

What is a Commercial Bridging Loan

What is a Commercial Bridging Loan? 1 – You could say a commercial loan is any asset put forward as security which is not classed as a pure residential property. 2 – Types of commercial assets - hotels, guest houses, pubs, warehouses, offices, retail units, industrial...

What are – REFURBISHMENT BRIDGING LOANS?

What are - REFURBISHMENT BRIDGING LOANS? 1 – Refurbishment bridging loans are a short term secured Bridging loan to assist your purchase 2 – A funder can offer you up to 75% gross loan towards your residential purchase and 70% gross loan for a commercial. 3 – You can...

Under Market Value Property Purchase Funding

UNDER MARKET VALUE PROPERTY PURCHASE FUNDING We funded the following transaction in July 2025 1 – Client who works in the building industry located 2 part finished detached houses that, the current owner could not complete due to ill health. 2 – The open market value...

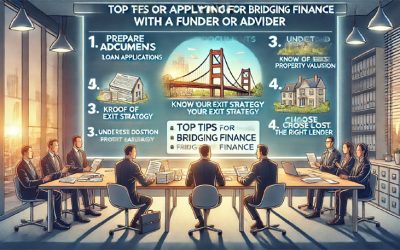

Tips for when applying for bridging finance with a funder or adviser

Tips for when applying for bridging finance with a funder or adviser The adviser or funder will require the following info to assist you further 1 – Your full name or company name if you are using a limited company for your purchase or refinance 2 – A description of...

Unregulated funding rates with one of our funders August 2025

Unregulated funding rates with one of our funders August 2025: Residential - up to75% Loan to value of the property at 0.75% fixed Per Calendar Month with max term 24 months Semi commercial property - 70% Loan to value at 0.82% fixed Per Calendar month Commercial...

Is It Easy To Obtain Bridging Finance?

Is It Easy To Obtain Bridging Finance? A bridging loan, what is it? Basically, a short-term financing solution to either fund the purchase of a new property or refinance an existing one. Providing efficiently timed funds to cover the purchase, renovation, or...

August 2025 rates and loan to values

August 2025 rates and loan to values Unregulated funding rates with one of our funders August 2025: Residential - up to75% Loan to value of the property at 0.75% fixed Per Calendar Month with max term 24 months Semi commercial property - 70% Loan to value at 0.82%...

What is the Biggest / Largest bridging Loan available?

What is the Biggest / Largest bridging Loan available? Well, the smallest Bridging Loans in the UK will be around 25,000.00 pounds The largest Bridge Loans can go up to 100 million pounds or more and are very dependent on the property being put forward as security for...

What property funding can you offer me?

What property funding can you offer me? Product range: from just one of our many funding lines Bridging Loans and Refurbishment Loans: From 0.74% per month, up to 75% LTGDV/LTV. Working off the Open Market Value. No exit fees for bridge loans. Part...

How long does it take for a Bridging Loan to complete?

How long does it take for a Bridging Loan to complete? When speed is essential—whether you’re purchasing a property at auction, preventing a chain break, or seizing a time-sensitive investment opportunity—bridging loans are often the solution. But how long does it...