by Mark | Aug 18, 2025 | Big Bridging Loans, Bridging finance

WHY USE BRIDGING FINANCE? My answer, why not as it has so many benefits when getting you from A to B in the arena of property matters. People in the know call it Bridging Finance and others, a Bridging Loan, both are correct in their terminology of this financial...

by Mark | Aug 12, 2025 | Big Bridging Loans

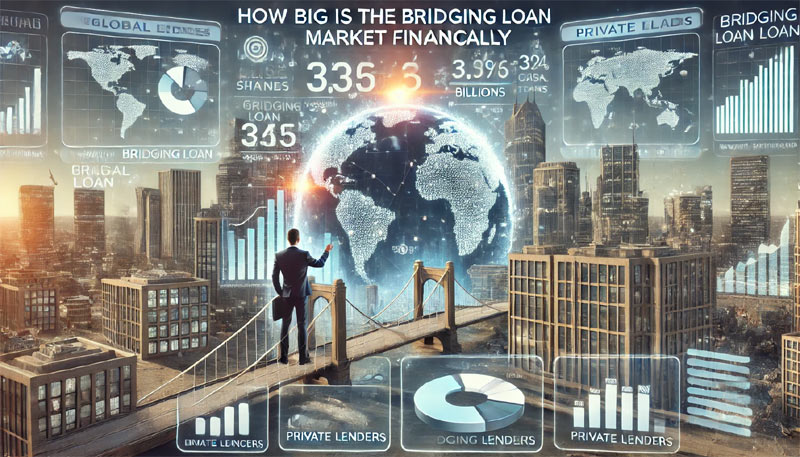

How big is the UK bridging loan market financially? The Bridge loan market which would also include development funding / lending, runs into billions of pounds being borrowed by limited companies and individuals for so many reasons ranging from purchasing a property...

by Mark | Aug 12, 2025 | Commercial Bridging Loans

What is a Commercial Bridging Loan? 1 – You could say a commercial loan is any asset put forward as security which is not classed as a pure residential property. 2 – Types of commercial assets – hotels, guest houses, pubs, warehouses, offices, retail units,...

by Mark | Aug 5, 2025 | Big Bridging Loans, Bridging finance

What is the Biggest / Largest bridging Loan available? Well, the smallest Bridging Loans in the UK will be around 25,000.00 pounds The largest Bridge Loans can go up to 100 million pounds or more and are very dependent on the property being put forward as security for...

by Mark | Aug 5, 2025 | Refurbishment Finance

What property funding can you offer me? Product range: from just one of our many funding lines Bridging Loans and Refurbishment Loans: From 0.74% per month, up to 75% LTGDV/LTV. Working off the Open Market Value. No exit fees for bridge loans. Part...