Mark Thomas: Bridging Finance Expert

Funding from £75,000 up to £25 million

Helping you secure a short-term financial solution to your specific bridge funding capital requirements

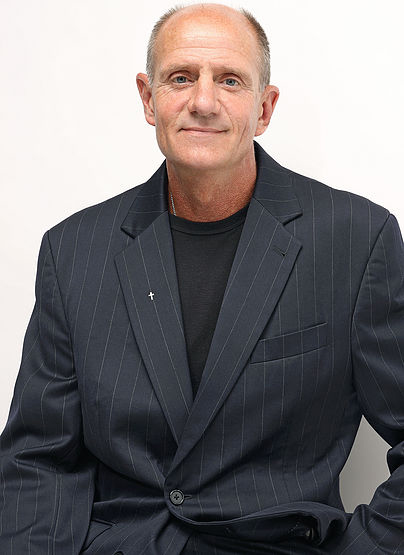

Mark D Thomas CEO

Bridging Finance Now

At nineteen, in 1984, Mark began his career with Legal & General in Haymarket, Central London, where he arranged life insurance and savings plans for families.

At nineteen, in 1984, Mark began his career with Legal & General in Haymarket, Central London, where he arranged life insurance and savings plans for families.

By the following year, his focus shifted to the mortgage sector, giving him valuable insight into financial planning and helping clients secure funding to take their first steps onto the property ladder—a role he continued in until 1991.

Mark returned to financial services in 1998 and went on to establish BT Mortgages in 2004. As a fully regulated mortgage consultant (CeMAP), he advised clients until the market downturn in 2008.

Today, Mark specialises in sourcing bridging finance and development funding for both individuals and businesses. Working alongside a highly resourceful team, he facilitates funding solutions ranging from £500,000 to £250 million, supporting clients through the entire process to completion.

Types of UK bridge funding clients:

Homeowners

Commercial & Residential Landlords

Buy to Let Investors

Business Owners

Property Developers

Company CEO’s

Bridging Finance Expert

A UK Bridging Finance Expert: The Key to Fast, Flexible Property Funding

In the dynamic world of property investment and development, timing is everything. Opportunities often arise that require swift financial action: the purchase of an undervalued property, the completion of a renovation project, or the need to secure short-term capital before long-term financing is arranged. This is where a bridging finance expert of the calibre of Mark Thomas becomes indispensable. A bridging finance expert is a professional who specialises in arranging short-term funding solutions, typically lasting from a few weeks to 24 months, designed to “bridge” a financial gap until a more permanent solution is secured.

Mark has a long track record of playing a pivotal role in helping clients access funding quickly, efficiently, and strategically. Unlike traditional bank loans, which can take months to process, bridging loans are designed for speed. A skilled expert understands how to navigate the complexities of this niche market, sourcing lenders who can complete deals in days rather than weeks. Mark works with a range of clients including property developers, investors, landlords, and even homeowners seeking to purchase a new property before selling their current one.

One of the key attributes of a UK bridging finance expert is market knowledge. The UK bridging sector has grown rapidly in recent years, with specialist lenders offering bespoke funding packages to meet diverse client needs. Mark Thomas has in-depth knowledge of lender criteria, interest rate structures, and loan-to-value ratios (LTVs), as well as a strong understanding of underwriting requirements and exit strategies. Mark acts as a strategic adviser, helping clients select the most suitable product and ensuring that all aspects of the loan, from valuation to legal due diligence, progress smoothly.

Equally important is Mark’s ability to tailor solutions. No two deals are identical. For instance, a property developer may need a refurbishment bridging loan to complete a project before refinancing, while a homeowner may require a short-term bridge to avoid a property chain collapse. Mark analyses each client’s situation, identifies potential obstacles, and structures the deal in a way that mitigates risk while ensuring the fastest possible turnaround. His network of lenders, often including private banks, peer-to-peer platforms, and boutique bridging providers, allows Mark to find creative solutions that traditional lenders cannot offer.

Compliance and transparency are also essential. The UK bridging market is regulated by the Financial Conduct Authority (FCA) when loans are secured on a borrower’s home. Mark ensures that all transactions adhere to regulatory standards, protecting clients from mis-selling and ensuring clarity on fees, interest rates, and repayment terms. Ethical practice builds trust and long-term client relationships, qualities that define the most reputable bridging professionals.

In today’s fast-moving property landscape, a UK bridging finance expert is more than a broker; they are a strategic partner who enables clients to seize opportunities with confidence. By combining speed, flexibility, and financial acumen, Mark will unlock the potential of the UK property market, turning time-sensitive challenges into profitable ventures. Whether for a multi-million-pound development or a simple residential bridge, Mark’s expertise ensures that funding obstacles never stand in the way of progress.